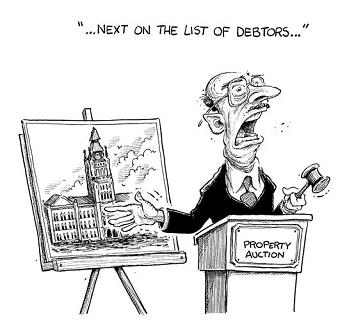

What is a Power of Sale Property?

In Ontario, Canada when a borrower defaults or fails to pay on a home mortgage, the Financial Institution or a lender most often attempts to recover its losses by repossessing and selling the property. "Power of Sale" Clause, sometimes inserted in mortgages or deeds of trust, which grants the lender (or trustee) the right to sell the property upon certain default or non-payment. The property is to be sold at auction but court authority is unnecessary.

Once the creditor is paid out of the net proceeds, the property is transferred by deed to the purchaser, and the surplus, if any, is returned to the debtor. The debtor is thereby completely divested of any interest in the property and has no subsequent right of redemption-recovery of property by paying the mortgage debt in full.

Power of Sale Alert Service:

We provide this service to advise the interested buyers in timely fashion the availability of properties that are being sold under this category. When decided to use this service, you will be advised by email the early morning of the next day when such properties are made public. All such email messages do contain most of the information about such properties to help you decide as to whether or not you like to find out more about and make an acquisition attempt.

Once you find a property that suits your needs, I will be more than happy to provide you all possible and related information to put you in best position to make an educated decission. I guarantee your experience will be a pleasant one!